TREE & LEAFS

INTRODUCTION!

No matter who you are, whether you have spent a lot of time navigating the "crypto" world or just like millions of people chasing fortune with cryptocurrencies, you will inevitably feel puzzled by this seemingly simple question.

❛❛ What is the difference between Coins and Tokens? ❛❛

This question has perplexed even the experts who have spent years buying and selling "cryptocurrencies," making them feel like their years of knowledge are back to square one.

Therefore, this article is very important in the knowledge toolkit of a skilled digital asset hunter. It helps you identify and pinpoint the real "Hidden Gems" in the vast and ambiguous world of millions of "crypto assets".

The content of this article is straightforward and easy to understand for anyone. It will provide you with a comprehensive and sharp perspective on the true nature of the entire bustling crypto industry out there. You will easily discern the nature of every "cryptocurrency" and "crypto asset" and classify them.

This article is divided into three parts:

Part 2: NOT-coin & TON-coin, what is a coin?

⚠️ ATTENTION - BEFORE YOU CONTINUE:

This article may mention the names of other projects or notable trends as illustrations to help explain basic concepts, not for promotion or criticism of any side. The article and its content are based on the compiled knowledge and subjective views of the writer and are not investment advice.

Part 1: TAP TAP MINI APP - HOT TREND!

Recently, projects following the "tap tap mini app" model on Telegram are being continuously released at a rapid pace, creating a wave that attracts those pursuing fortune in "digital money."

Each mini app often consumes a lot of the player's time, requiring them to play a "tap on the screen" game for several tens of minutes each day, counting taps illustrated by coins. If a player pursues fortune in multiple mini Apps simultaneously, they could spend hours, even many hours each day.

Is this a problem? When we once thought Bitcoin consumed a lot of energy, while the mini app trend is burning the time of millions of people, potentially affecting their work, study, and production efficiency as they chase the trend of tapping on the screen to find what they call "digital money.".

So the question arises, "What exactly are Telegram mini apps?" With thousands of similar "tap tap" games being published, are they "cryptocurrencies"? Do these "tap tap" games relate to cryptocurrencies or blockchain, and to what extent?

Telegram & the Digital Money Printing Industry

First, let's talk about Telegram's capabilities. It is an OTT messaging app, and can this app create digital money? Was Telegram designed to mint cryptocurrencies?

At the time of writing, the Telegram messaging app still has no direct link to developing digital currencies or providing any services that allow the publication of digital currencies.

Telegram - The Social Network of the Crypto

Being a place where many people supporting Crypto gather to discuss and share information, Telegram attracts development groups or market operators for two main reasons:

• Convenient mini app creation functionality:

Although not directly related to Blockchain, this OTT app has a feature to create mini apps inside conveniently, making Telegram a choice for groups to create "tap tap" games and promote these mini apps as potential "cryptocurrencies.".

• A large number of cryptocurrency supporters:

Telegram hosts millions of people with thousands of groups discussing crypto-related content. It is a place where developers, crypto hunters, and those chasing the "crypto" trend to find fortune congregate.

However, the nature of mini apps is not the state of a cryptocurrency. You can consider it an early introduction to a cryptocurrency, but it is not yet a cryptocurrency.

Telegram is not a Blockchain, so it does not have any mechanisms to help create digital currencies based on blockchain like other real blockchain platforms, such as Ethereum, Cardano, or Solana...

Telegram (OTT) is very different from Ethereum (Blockchain Platform)

While Telegram is an OTT messaging app, designed for instant messaging and communication, Ethereum is a first-layer blockchain decentralized database system.

If Telegram's business revolves around instant messaging features, selling you Premium access packages and charging users monthly or yearly fees, Ethereum's primary business is providing a service that allows you to create "crypto tokens" or "NFT tokens" based on smart contract setup on the Ethereum blockchain and charging network fees with the blockchain's native asset (ETH).

For example, you can define the ticket name, create the symbol, enter the quantity, and set the logo for your digital currency easily and deploy it on Ethereum's blockchain with the service fee paid in ETH.

Mini app - Hot TREND!

Recently, the "Tap tap mini app" trend has become hot, with Telegram's advantage of tens of millions of active users in crypto content attracting developers wanting to quickly reach users for their projects.

Though called "mini applications," these Mini Apps are not real applications. They depend entirely on another application, Telegram, and cannot operate independently outside Telegram like real applications published on Chplay or Appstore.

The number of users searching for fortunes in crypto on Telegram is large but still a finite number., and the race to publish mini apps has become fiercely competitive under under pressure to reach users "the sooner, the better." Thus, mini apps have replicated similarly to launch their mini apps as quickly as possible. This fierce race has seen thousands of similar mini apps released in a short time, leading to an excess and a state of inflation.

Tokens & The Inflation

Inflation is always a haunting issue with the concept of currency in general. Fiat currencies (*) often inflation due to new money printing activities annually or economic regulation. Excessive inflation concerns lead many to seek an anti-inflation solution to store money without losing value.

Many believe that "cryptocurrencies" are a good remedy for inflation, thinking that cryptocurrencies, with their locked supply rules from the moment of token issuance, will ensure inflation control. But they are wrong, forgetting that there is no limit on the number of cryptocurrencies.

Today, there are more and moreservices offering crypto token creation protocols like ERC-20, BEP-20, TRC-20 ... allow anyone to create a token at nearly zero cost without any censorship.

Even "printing" a new currency through these protocols requires almost no skill, taking about 10 minutes and costing around $2 on BEP-20, TRC-20... Subsequently, most of these tokens are introduced as cryptocurrencies. Printing tokens and owning a new currency seems too easy, so statistics show that around 1 million new tokens were created in April 2024.

Now let's continue discussing NOT-coin, a prominent project in the Tap Tap mini app trend. How did NOT-coin succeed in becoming a well-known "coin," and is it truly a "coin"? Let's continue with part 2.

Part 2: NOT or TON - Which is call the coin?

What is NOT-COIN?

NOT-coin was born by accident when someone mistakenly wrote TON by backwards, and this accident created NOT.

NOT-coin (let’s temporarily call NOT a "coin" until we understand better what it is) is the "coin" that launched a new airdrop trend currently known as "Tap To Earn.".

NOT-coin is considered one of the first markers revealing the main meaning and application of the TON blockchain. It tells you that the TON blockchain is a new player in providing smart contract services.

Recently, with the rapid success of the "Tap To Earn" movement, TON-Blockchain is seen as having an impressive debut with the impressive dapp product NOT-coin. NOT-coin has truly made a splash, thereby promoting the TON Blockchain, helping it to enter the leading group. It promises to make TON the next major player in the service of creating cryptocurrencies, competing with other big platforms like Ethereum, Binance, or even Solana which is currently seen as "the king of meme coins".

TOKENS or COINS?

The truth is that most people seeking crypto fortune in trend, can hardly distinguish between "Tokens" and "Coins". Because most Cryptos introduced somehow have the keyword "coin" in their name.

A specific look at Not-coin & Ton-coin

They look very similar, both have the keyword "coin" in their name. Do you feel confused by the question "between TON-coin and NOT-coin, which one is the coin, and which is the token?" I bet that most players, if just look at the name, would feel very confused.

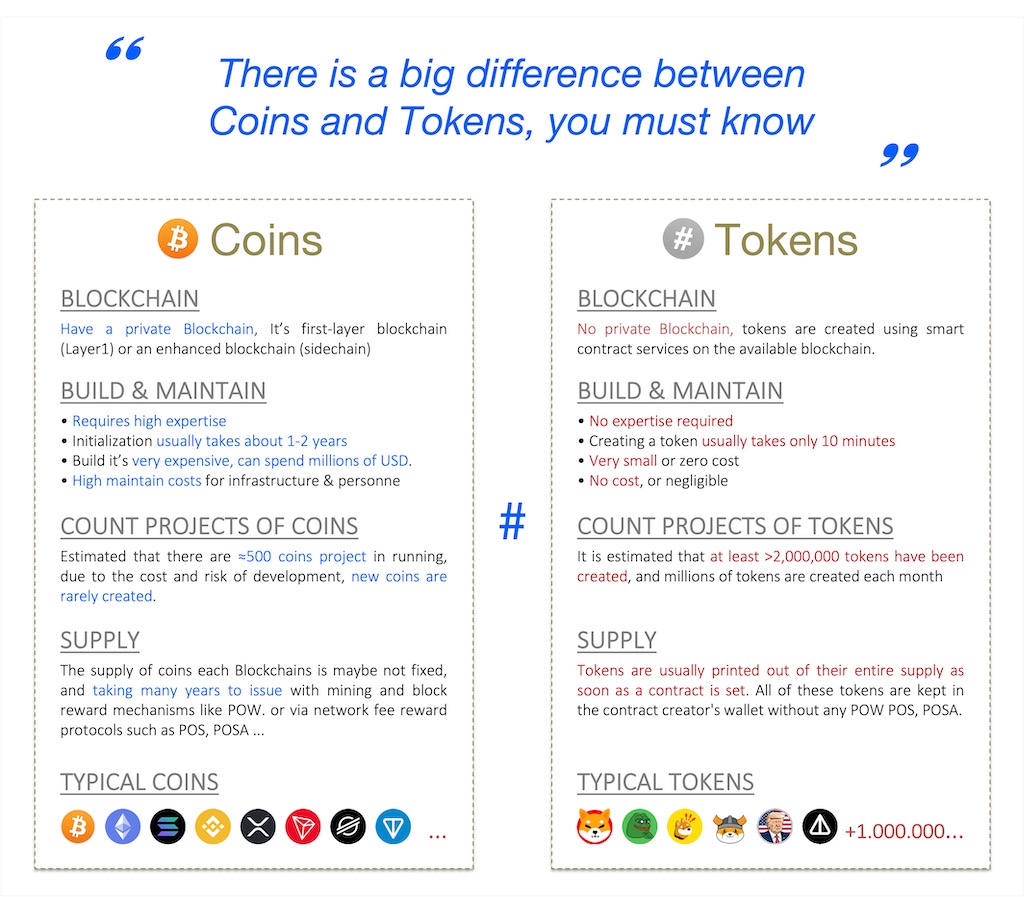

Compare below shows the differences between Coins and Tokens

Classification of Coins & Tokens

Classification of Coins & Tokens

Based on a few summarized characteristics above, it can be seen that even in the first feature points out that NOT-coin is a "token", despite having the keyword "coin" in its name. It is indeed a token because it does not have its own blockchain; instead, NOT-coin operates entirely dependent on the blockchain "The Open Network," abbreviated as TON.

Most Cryptos you earn are Tokens

Not only NOT-coin, allmost of the "cryptocurrency" you can easy to earn are tokens.

Today, due to the difficulty and big cost of developing a Blockchain project, developing a separate blockchain is too risky, making projects with coins very rare. Conversely, creating a new token is very simple, quick, and cheap, yet still associated with the keyword "coin" in the name. Therefore, the truth is that among the millions of new "cryptocurrencies" or "coins" you can easily access out there, most of them are "Tokens."

GAS Fees

To further solidify the classification more clearly, let’s look at the factor of network GAS fees. NOT-coin is a token operating on TON, so when moving NOT tokens on the TON Blockchain network, you will have to pay the network gas fees in TON-coin. Thus, TON is the native coin of The Open Network. This is similar to other blockchains like Ethereum (paying fees in ETH), Solana (paying fees in SOL), or Binance (paying fees in BNB)...

Part 3: TREE & LEAVES

In the world of countless "Cryptos" or "cryptocurrencies" with millions of names, over time, millions more will emerge, and this list will continue to grow almost endlessly. However, in reality, only a few of those millions of names will truly become valuable assets.

You don't have the time or resources to approach millions of types of Crypto, just as you don't have enough money to buy every ticket in the Mega Power Ball lottery to ensure a win. So, how do you hunt for a potential asset early on?

The previous sections have mentioned the concepts of Coins and Tokens, which is an effective criterion for filtering. Let's start with the first question.

"Between COINs and TOKENs, which is more valuable?"

By simulating the "Tree & Leaves" model of a long-lived timber tree, you will have your answer.

THE TREE & LEAVES MODEL

To better visualize the relationship between different types of digital assets and cryptocurrencies in general, they are often categorized into two conceptual categories: "COINS" and "TOKENS."

First, let's list the famous COINS that come with blockchain infrastructure, such as Bitcoin, Ethereum, Binance Smartchain, Cardano, The Open Network, Solana...

If each platform is described as a large tree trunk, then the millions of tokens operating on it are like the millions of leaves on the tree, with these leaves existing with the life force provided by the original asset units like BTC, ETH, BNB, ADA, TON, SOL...

In terms of value, within the Tree & Leaves model, the tree trunk typically holds greater economic value. Each tree has only one trunk, which usually persists for many years, while the Tokens are seen as the leaves that grow on that tree. Leaves typically have a shorter lifespan and are replaced seasonally. The "new" leaves of this season will "wither" in the next season, and they might even disappear after a strong gust of wind.

This is why the original assets of a blockchain are usually expensive. Specifically, let's consider a few large trees in the world of Crypto Blockchain.

ETHEREUM

Take, for example, the blockchain ecosystem of the "Ethereum Tree," you will see that the Ethereum blockchain has shown sustainable asset growth over many years, with its native asset being ETH coins, which serve as the lifeblood of this ecosystem and have become increasingly valuable due to the demand from Layer2s and Dapps. Observe that ETH started with a price of just $0.3 in 2014, and today each ETH unit is worth up to $4500.

The growth in ETH's price is driven by increasing demand. As more "Token leaves" grow on the Ethereum trunk, they require more and more ETH, and even later, as its larger branches (Layer2s, 3s) emerge, all of them consume ETH to pay fees.

Over many seasons, the ETH trunk has grown larger and more famous, the tree has sprouted more branches and more leaves, but pay attention to the leaves—they change with the seasons, with new leaves overshadowing the old ones. In fact, many leaves from previous seasons have withered and been forgotten.

BITCOIN

Each tree species has a different mission, and there is a special tree: Bitcoin. You might ask whether Bitcoin is a tree or a leaf. The answer is, "Bitcoin is indeed a tree," an independent tree based on its own distinct blockchain roots.

This special tree may not have leaves, but it remains a tree with a strong life force, enduring despite the harshness of the environment it chooses. Bitcoin has the most powerful and reliable blockchain; it has no leaves (token leaves) but has an extremely reliable flow of nutrients—BTC—that has helped it become the most resilient tree in the "crypto tree world."

"TON Tree"

One of the most promising trees in the world of crypto trees, the TON Tree grew on the ideal soil of Telegram, so it is no surprise that the TON Tree quickly showed its potential as a princely seed.

In just a short time, the TON Tree, based on the enormous population resources of the Telegram kingdom, quickly developed to become a powerhouse in providing crypto contract services, challenging the elder trees like Ethereum, Binance Smartchain, Tron, and even Solana—the king of meme coins.

Like other trees, the TON Tree has its original asset unit—TON—which was quickly valued by the market at up to $20 billion, becoming a major player.

ANTS - DON'T BUILD NESTS ON LEAVES.

In long-term growth investing, you need to seek assets with good growth potential, which is akin to intelligent ants choosing where to build their nests. They will certainly choose a tree trunk or large enough branch to build their nests with a long-term vision. Even the tiny ants with very limited intelligence easily recognize the sustainable value of the tree trunk; they always bet on the tree rather than the leaves.

As an investor, a potential digital asset hunter reading this article, you surely now know how to act when faced with the choice between Trees and Leaves.

In reality, many people find it difficult to access and gain a position on large trees. For example, if you want to hold a position on Bitcoin, Ethereum, or even the newcomer TON, you would have to pay a hefty price to own a % rate very small. Indeed, this is because those trees have already grown, big and become well-known.

RARE TREE HUNTER

You need to become an early rare tree hunter as soon as possible. You need to have enough sharpness to recognize the seed of a complete young tree early on. These young trees, at first glance, appear as just a small green dot indistinguishable from the leaves. If you find them and approach them early while they are still sprouting, you will gain a significant position and potentially completely change your financial landscape in the next few years.

To identify a "potential tree seed," pay attention to the most recognizable characteristic: it usually grows low to the ground, not on a tall tree. Those little green dots on the ground or those tiny hidden corners have the potential to be sprouts taking root.

A private blockchain is the root system of a young tree! As an experienced blockchain crypto asset hunter, you must always remember to look for projects with their own blockchain orientation and a clear determination to build their distinct blockchain.

RUBI is a project striving to build its own blockchain, with a vision to operate and tokenize interactions on the internet into public digital assets. The internet space and interactions represent a massive marketing market, valued at trillions of dollars. Rubi Network is one of the earliest tree seeds building a blockchain to conquer this domain, and it is also the earliest blockchain aiming to define digital assets as theory "Crypto Commodities".

Thank you for following my content!

Good article - Donate to the author

(*) Each country has only one currency issued according to the national constitution, a total of about ≈180 legal currencies used to pay for consumer goods in countries. The issuance of additional fiat money is strictly regulated by the national central bank

Comments (79)

amin313

Hello

1 Trả lời Chia sẻ 03:30 21/12/2024

0 trả lời

baqirhussaini

Hi please help me ????

2 Trả lời Chia sẻ 03:07 18/12/2024

0 trả lời

mianaamir

How to change wrong pics in kyc process

2 Trả lời Chia sẻ 20:34 14/12/2024

0 trả lời

mianaamir

Please help in the wrong pics in kyc process

1 Trả lời Chia sẻ 20:32 14/12/2024

0 trả lời

AnsiaRiaz

Interesting

1 Trả lời Chia sẻ 11:32 14/12/2024

0 trả lời